Foreclosures, short sales, bank-owned properties, and REO properties are some distressed properties that present themselves as enticing opportunities for savvy investors.

While these properties can be transformed into profitable investments, they often require significant repairs and renovations. Buying a distressed property can be time-consuming due to legal complexities and potential title issues.

When done blindly, they may turn into financial nightmares. Hence, the need to arm yourself with these 10+ warning tips for buying distressed properties. This article explains in detail what you need to do right to benefit from a lucrative deal.

Table of contents

- What Is A Distressed Property?

- What are the Types of Distressed Properties?

- Why Buy a Distressed Property?

- How to find distressed properties

- 10+ Warning Tips for Buying Distressed Properties

- #1. Get Pre-Approved for a Mortgage

- # 2. Find an Experienced Agent

- # 3. Don’t Invest in a Distressed Neighborhood

- # 4. Get a Professional Home Inspection

- # 5. Be Ready to Make Repairs

- #6. Familiarize yourself with the local jurisdiction

- #7 . Be Patient

- #8. Know Your State’s Foreclosure Laws

- #9 . Have Cash at Hand

- #10. Make a Serious Offer

- #11 . Utilize Your Lender’s Appraisal Strategically

- Where is the best place to buy distressed property?

- Frequently Asked Questions

- Conclusion

- References

- Recommendations

What Is A Distressed Property?

A distressed property is a real estate asset that is financially troubled, often due to the owner’s inability to make mortgage payments or property taxes.

These properties may be on the verge of foreclosure or already repossessed by the lender.

They are typically sold at a discount compared to their market value, making them an attractive option for investors seeking potential profits.

Although Distressed properties may require renovations or repairs, their potential for increased value after renovations can create equity opportunities for buyers.

Read Also: How Selling a House Works | What to Know Before Selling

What are the Types of Distressed Properties?

The types of distressed properties are generally identified by what made the property distressed. For instance, when a homeowner fails to make mortgage payments, the lender repossesses the property.

This type is called foreclosure and is typically sold at auction or through a listing agent. Other types of distressed properties include:

- Short sales: These are properties that are being sold by the homeowner for less than the outstanding mortgage balance. The lender must agree to accept the short sale proceeds in exchange for releasing the lien on the property.

- Bank-owned properties (REOs): These are properties that have been repossessed by the lender and are now being sold directly by the bank. REO properties are often in need of repairs or renovations.

- Fixer-uppers: These are properties that are in need of significant repairs or renovations. Fixer-uppers can be a good investment opportunity for buyers willing to work to bring the property up to code and make it habitable.

- Inherited properties: These are properties that have been passed down from a deceased family member. Inherited properties can be distressed if the heir is unable to afford the upkeep or taxes on the property.

Read Also: How House Moving Works

Why Buy a Distressed Property?

Buying a distressed property comes with notable pros and cons. If you buy one with the right information, it is a lucrative deal. However, when done blindly, they can turn into a financial nightmare.

Consider these pros and cons below before buying a distressed property.

Pros

- 1. Lower Purchase Price: Distressed properties are often sold at a significant discount compared to their market value. This can make them an attractive option for budget-minded buyers who are looking for a good deal.

- 2. Potential for Quick Sale: Lenders are often motivated to sell these properties quickly, which can streamline the closing process for buyers. This can be especially appealing to investors who are looking to flip the property for a profit.

- 3. Equity Potential: Distressed properties may require renovations or repairs, but the potential for increased value after renovations can create equity opportunities for buyers. This can be a great way to build wealth over time.

- 4. Unique Properties: Distressed properties can sometimes be found in desirable neighborhoods or have unique features that are not found in other properties. This can be a good option for buyers who are looking for a one-of-a-kind home.

- 5. Tax Benefits: In some cases, buyers of distressed properties may be eligible for tax benefits. For example, the Mortgage Forgiveness Debt Relief Act of 2007 allows homeowners to exclude up to $100,000 of forgiven mortgage debt from their taxable income.

Read Also: How To Kick Someone Out Of Your House? A Polite Way

Cons

- Hidden Defects: Distressed properties may have hidden defects or structural issues that are not apparent during initial inspections. This could lead to costly repairs down the road.

- Legal Complications: Some distressed properties may have title issues, liens, or other legal problems that could complicate the closing process or lead to future disputes.

- Renovation Costs: They often require significant repairs or renovations. This can be a major financial burden, and it is important to factor in these costs before making an offer.

Read Also: Best Grants for First Time Home Buyers in Utah

How to find distressed properties

Finding distressed properties can be rewarding when it turns out to become a lucrative deal. However, you must approach this process with caution and thoroughness to avoid potential pitfalls.

To find distressed properties near you, visit:

- Online Real Estate Platforms: Collaborate with experienced real estate agents specializing in such properties like Zillow, Trulia, and Realtor.com. These platforms often have specific filters for foreclosures, short sales, and bank-owned properties.

- 2. Local Foreclosure Listings and Auctions: Check local newspapers, courthouse bulletin boards, and online auction platforms for listings of foreclosed properties scheduled for auction. Attending auctions can offer opportunities to negotiate favorable deals.

- 3. Identify Properties with Delinquent Mortgages: Homeowners who struggle to make their mortgage payments are at risk of foreclosure, making them more likely to consider selling their properties at a discount to avoid the financial burden of foreclosure proceedings. Fortunately, public records at local courthouses provide valuable information about delinquent mortgages.

- 4. Driving for Distressed Signs: Drive through neighborhoods with high foreclosure rates and keep an eye out for signs indicating vacant, for sale, or distressed properties. This can lead to discovering properties not yet listed on the market.

- 5. Public Records and Court Filings: Access public records and court filings to identify properties in foreclosure proceedings, bankruptcy cases, or tax delinquency situations. These records can provide valuable leads on potential distressed properties.

To Find Distressed Commercial Real Estate For Sale, check

- Commercial investing websites

- Brokers

- Lenders

- Direct mail campaigns

- Networking and Word-of-Mouth

10+ Warning Tips for Buying Distressed Properties

As earlier established, buying distressed properties with the right information increases the chances of it becoming a lucrative deal. Here are some warning tips you must adhere to while buying one:

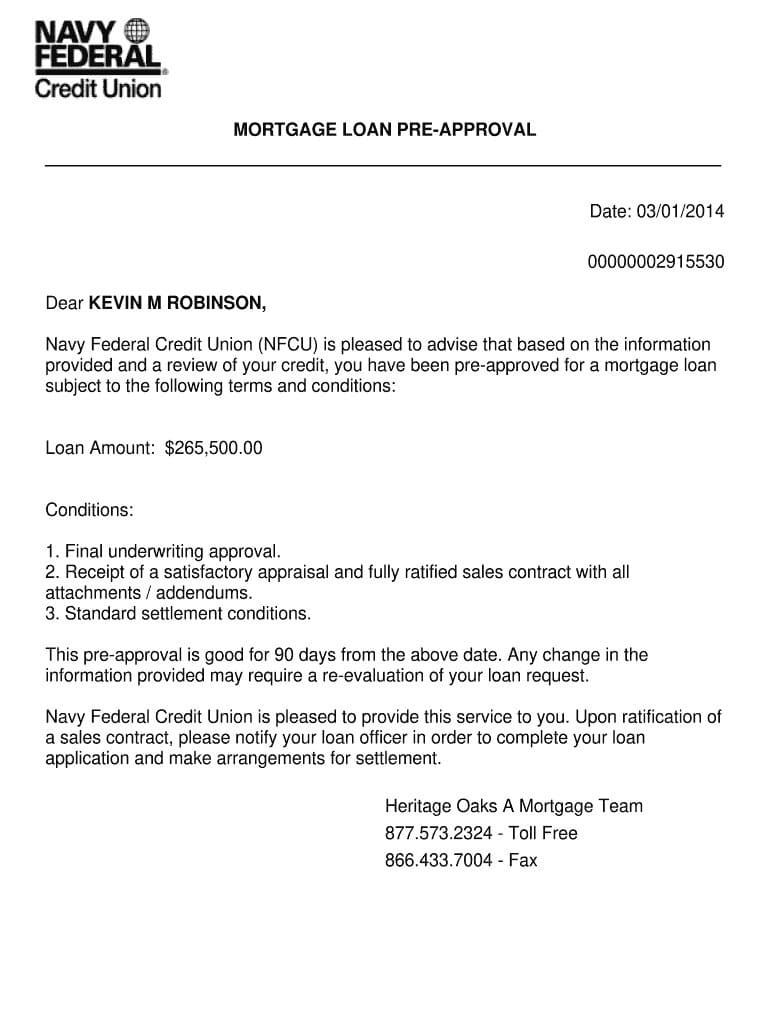

#1. Get Pre-Approved for a Mortgage

Before you start looking at distressed properties, it’s important to get pre-approved for a mortgage.

This will show sellers that you’re a serious buyer and that you have the financial wherewithal to close on a deal.

It will also give you a better understanding of your budget and how much you can afford.

Read Also: Breaking At-Home Learning Fatigue

#2. Find an Experienced Agent

Working with an experienced real estate agent who specializes in distressed properties can be invaluable.

They can help you find the right properties, negotiate the best price, and guide you through the complex closing process.

#3. Don’t Invest in a Distressed Neighborhood

Just because a property is distressed doesn’t mean it’s a good investment. If the property is located in a not-so-good neighborhood, it may be difficult to sell later on and you may have difficulty getting financing.

#4. Get a Professional Home Inspection

Distressed properties often need a lot of work, so it’s important to get a professional home inspection before you buy.

This will help you identify any potential problems with the property and give you an estimate of the cost of repairs.

#5. Be Ready to Make Repairs

They often need a lot of work, so you need to be prepared to make repairs. This can include everything from fixing a leaky roof to replacing a major appliance.

#6. Familiarize yourself with the local jurisdiction

A public records search will reveal many distressed properties. That’s why it’s important to familiarize yourself with your local government. Introduce yourself to the county clerks.

Learn where auctions are held, and keep a folder on your computer of any necessary government websites. Each of these steps will help maximize your overall efficiency.

#7. Be Patient

Its market can be very competitive, so you need to be patient. It may take some time to find the right property and get a good deal.

#8. Know Your State’s Foreclosure Laws

Each state has its own foreclosure laws, so it’s important to know the laws in your state before you buy one. This will help you avoid any legal problems down the road.

#9. Have Cash at Hand

Distressed property sellers often prefer cash offers or require a substantial down payment. Be prepared to have readily available funds to demonstrate your ability to close the deal promptly.

#10. Make a Serious Offer

When making an offer, be prepared to negotiate aggressively and present a competitive bid that reflects the property’s true value, considering any necessary repairs or renovations.

#11. Utilize Your Lender’s Appraisal Strategically

Work with your lender to ensure the appraisal reflects the property’s potential value after renovations or repairs. A fair appraisal can protect you from overpaying or facing appraisal-related delays.

Where is the best place to buy distressed property?

The best place to buy distressed property depends on your individual circumstances and goals.

Generally, Detroit, Michigan; Atlanta, Georgia; Las Vegas, Nevada; Phoenix, Arizona; and Jacksonville, Florida are great places to buy a distressed property.

However, you should consider the factors below before making the final decision.

- Cost of living: The cost of living in an area can have a significant impact on the affordability of these properties.

- Foreclosure rates: Areas with high foreclosure rates may have more of these properties to choose from, but they may also be more competitive.

- Job market: Areas with strong job markets are typically more desirable to buyers, which can lead to higher prices for them.

- Inventory: Areas with a large inventory of these properties may be more likely to have lower prices.

- Your personal preferences: Consider your desired location, budget, and investment goals when making your decision.

Frequently Asked Questions

Distressed properties include foreclosures, short sales, bank-owned properties (REOs), fixer-uppers, and inherited properties.

Risks include hidden defects, legal complications, renovation costs, vacancy issues, and potential environmental hazards.

The potential for savings and equity creation can make them attractive investments, but careful consideration of risks and renovation costs is crucial.

Potential benefits include acquiring a property at a reduced price, bypassing the traditional bidding process, and securing a home with equity potential.

The best site to find distressed properties

Auction.com

Foreclosure.com

HomePath by Fannie Mae

HUDForeclosed.com

RealtyTrac

Conclusion

Get all the benefits of buying a distressed property when you arm yourself with the right information. This article compiles 10 warning tips you must adhere to amass lucrative deals in distressed properties.

References

- Retipster.com – 9 Types of Distressed Properties and How to Find Them

- Fortune Builders.com – 9 Hacks For Finding Distressed Properties For Sale

- Forbes.com – The Do’s And Don’ts Of Investing In Distressed Properties